Biography

I am an economist at the Federal Reserve Board. My research focuses on U.S. labor markets, macroeconomics, and their trends and cyclical interaction. I am interested in questions about labor market polarization, labor market flows, forecasting, as well as studying current labor market developments.

This my personal website. Any views expressed on this site are my own and do not necessarily represent the views or policies of the Board of Governors of the Federal Reserve System or its staff. My official website is here.

Interests

- Macroeconomics

- Labor economics

- Applied econometrics

Education

-

Ph.D., Economics, 2008

University of California, San Diego

-

BA, Economics, 2000

University of California, Berkeley

Recent research

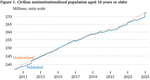

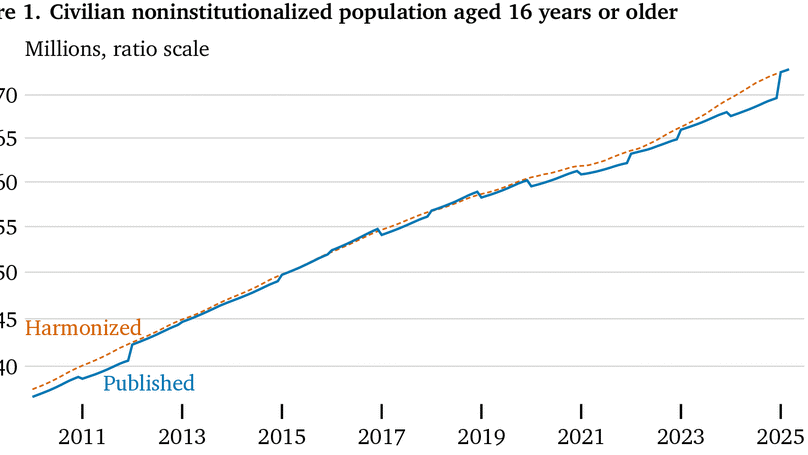

Harmonized Population and Labor Force Statistics

This paper constructs harmonized estimates of population and labor force statistics that smooth out discontinuities in published BLS statistics stemming from annual population estimate updates.

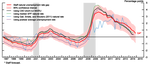

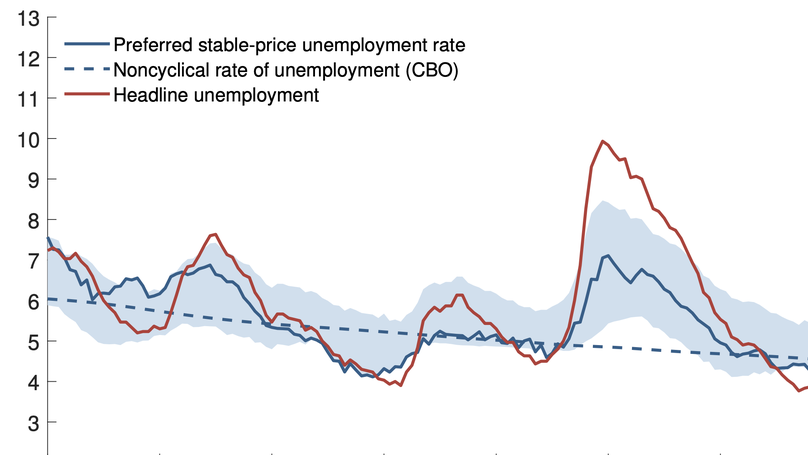

Estimating Natural Rates of Unemployment: A Primer

Before the pandemic, the U.S. unemployment rate reached a historic low that was close to estimates of its underlying longer-run value and the short-run level associated with an absence of inflationary pressures. After two turbulent years, unemployment returned to its pre-pandemic low, and the estimated underlying longer-run unemployment rate appeared largely unchanged. However, economic disruptions pushed up the short-run noninflationary rate substantially, as high as 6%. This primer examines these different measures of the natural rate of unemployment and discusses how they can provide useful insights for policymakers.

Journal publications

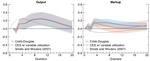

Across The Universe: Policy Support for Employment and Revenue in the Pandemic Recession

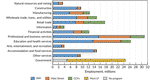

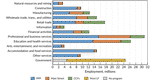

The Dynamics of Disappearing Routine Jobs: A Flows Approach

Web publications

Updating the Labor Market Conditions Index

Working papers

Estimating Natural Rates of Unemployment: A Primer

Across The Universe: Policy Support for Employment and Revenue in the Pandemic Recession

Contact

- christopher.j.nekarda@frb.gov

- federalreserve.gov

- Google Scholar

- ORCHID iD

- GitLab