Estimates of U.S. stable-price rate of unemployment

Estimates of U.S. stable-price rate of unemployment

Abstract

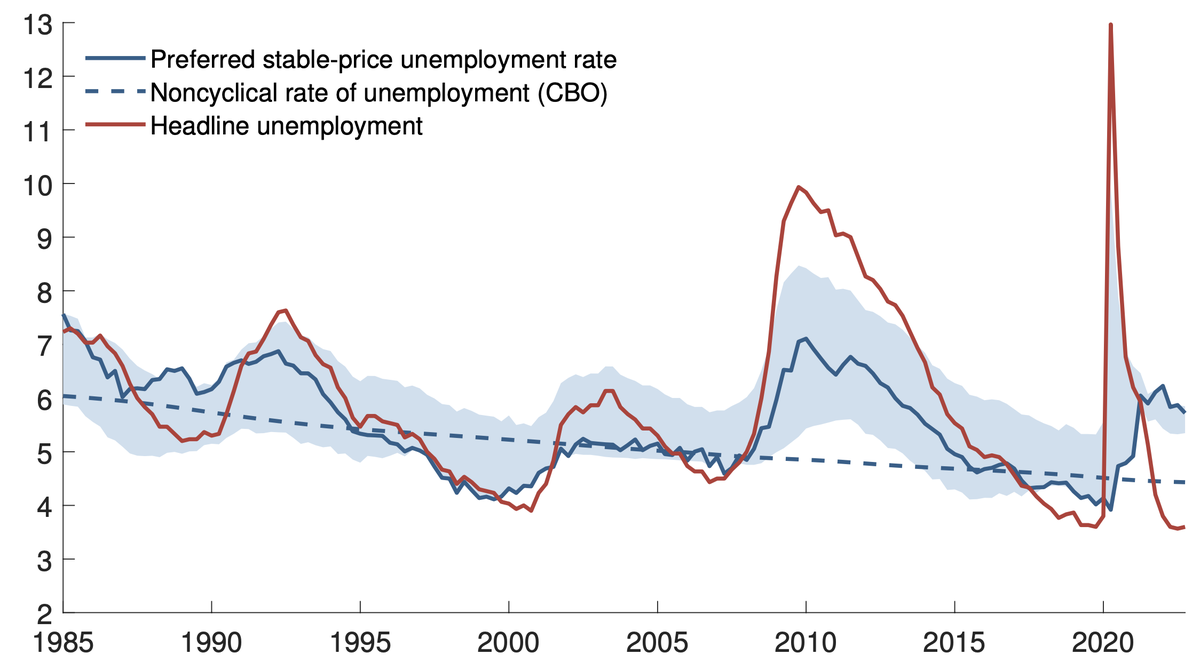

Before the pandemic, the U.S. unemployment rate reached a historic low that was close to estimates of its underlying longer-run value and the short-run level associated with an absence of inflationary pressures. After two turbulent years, unemployment returned to its pre-pandemic low, and the estimated underlying longer-run unemployment rate appeared largely unchanged. However, economic disruptions pushed up the short-run noninflationary rate substantially, as high as 6%. This primer examines these different measures of the natural rate of unemployment and discusses how they can provide useful insights for policymakers.

Type

Publication

Bok, Brandyn, Richard K. Crump, Christopher J. Nekarda, Nicolas Petrosky-Nadeau (2023). “Estimating Natural Rates of Unemployment: A Primer,” Federal Reserve Bank of San Francisco Working Paper 2023-25, August 2023.