The Cyclical Behavior of the Price-Cost Markup

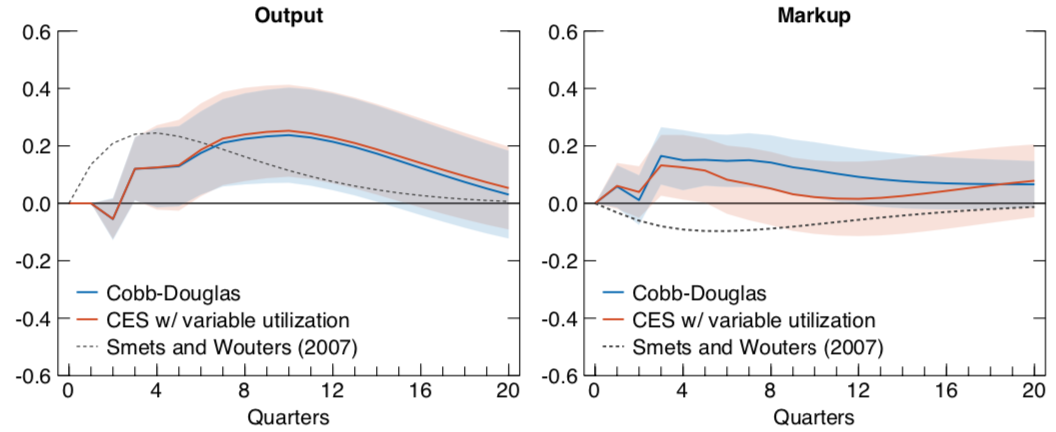

Impulse response of response to an expansionary monetary policy shock

Impulse response of response to an expansionary monetary policy shock

Abstract

A countercyclical markup of price over marginal cost is a key transmission mechanism for demand shocks in New Keynesian (NK) models. This paper re-examines the foundation of those models by studying the cyclicality of the price-cost markup in the private economy. We find that how the markup is measured matters for its unconditional cyclicality. Measures of the markup based on the inverse of the labor share are moderately procyclical, but are moderately countercyclical for some generalizations of the production function. NK models predict that the cyclicality of the markup should vary depending on the nature of the shock. Consistent with the NK model, we find that the markup is procyclical conditional on TFP shocks and countercyclical conditional on investment-specific technology shocks. In contrast, we find that the markup increases in response to a positive demand shock. Thus, the transmission mechanism for the effects of demand shocks in sticky-price NK models is not consistent with the data.

Other versions

- June 2013 – NBER Working Paper 19099 (0.30 MB PDF)

- June 2009 – Unpublished paper