Cross correlations with the unemployment rate

Cross correlations with the unemployment rate

Abstract

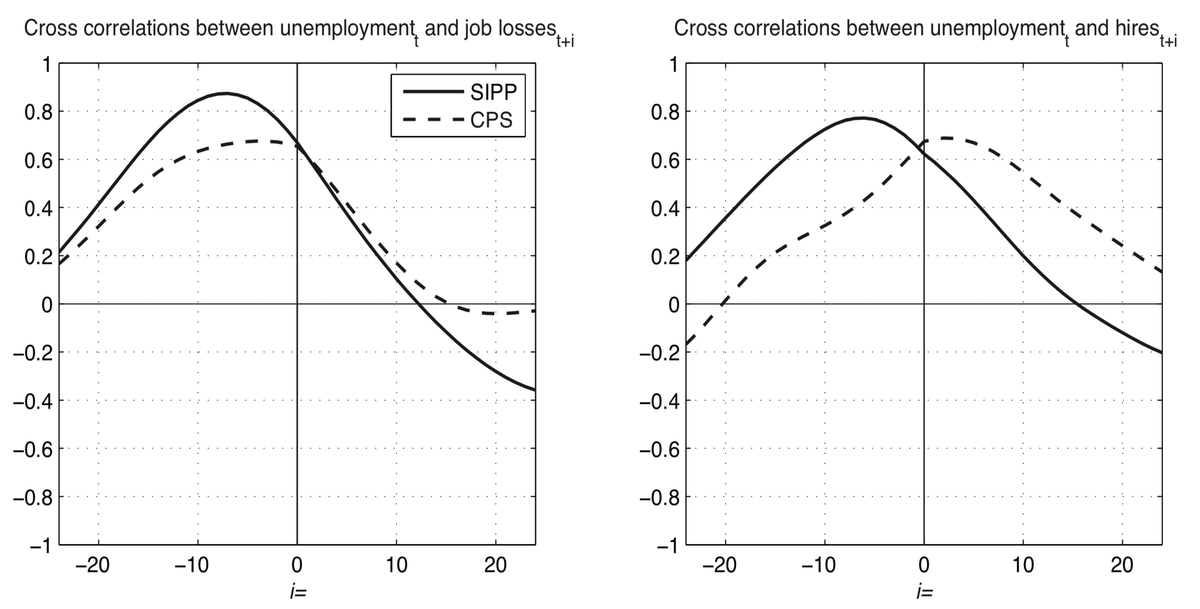

Drawing on CPS data, Fujita and Ramey (2006) show that total monthly job loss and hiring among U.S. workers, as well as job loss hazard rates, are strongly countercyclical, while job finding hazard rates are strongly procyclical. They also find that total job loss and job loss hazard rates lead the business cycle, while total hiring and job finding rates trail the cycle. In the current paper we use information from the Survey on Income and Program Participation (SIPP) to reevaluate these findings. SIPP data are used to construct new longitudinally consistent gross flow series for U.S. workers, covering 1983–2003. The results strongly validate the Fujita-Ramey findings, with two important exceptions: (1) total hiring leads the cycle in the SIPP data, and (2) the job loss rate is substantially more volatile than the job finding rate at business cycle frequencies.